Market Expansion Strategies and Frameworks for Product Managers: A Guide

When companies think about expanding product offerings into new markets - this could include new target customer segments, new product categories, new industries, new geographical markets, or online vs. retail markets – there are typically more than a few challenges to overcome.

Just some of the obstacles organizations often face when expanding into new markets include regulatory challenges, increased overhead and resources required to handle things like translation and increased support, significant amounts of research to inform changes, cultural differences, competing with other established players who are already in these markets, logistics and supply chain management, tech stack changes, complexity, and unknowns, how to market these changes with your existing customer base and publicly handle messaging, and significant business and financial risks.

To do this with poise, confidence, and exceptional execution, teams should make sure the “Why” for expanding into this new market is well defined, understood, and aligned within your organization, and your desired outcomes have been tangibly thought about and outlined publicly within the company, and you have a solid understanding of the context (i.e.market condition, trends, competitors, and opportunities) and also constraints (i.e. budget, runway, and the technical and logistics-related complexity) involved to expand.

Understanding Market Expansion

Market expansion is when a company makes an effort to increase its sales, revenue, and market share by entering a new market or expanding its presence in existing markets. It involves identifying new opportunities for growth and developing strategies to capture a larger share of the market.

Some real-world examples of market expansion strategies include:

In-person to online → Netflix: Originally a direct-to-consumer DVD delivery service, they expanded into the online market by offering digital streaming.

New products → Apple: Originally known for their computer hardware and software, Apple introduced new products like the iPod, AirPods, and Apple Watch to expand into new markets.

Acquisitions → Coca-Cola: The soft-drink giant acquired Gatorade in 2001 to try to expand into the non-carbonated and sports-drink markets.

Conducting Market Research

By far the most important step when it comes to market expansion is due diligence on the market research front. When conducting market research, it’s important to first define your research objectives. What do you need to learn and why are these things important to you?

Then, look at variables like:

The identification of new market opportunities

The size of new markets under consideration

Trends and predictions in these markets

Economic conditions

Competitors (direct, indirect, tertiary)

Customer feedback on products in these markets

Technology considerations (i.e. current capabilities, future innovations, etc.)

Regulatory considerations

Cultural considerations

Doing this thoroughly is important and using a variety of research tools is crucial when approaching this holistically - market research reports, surveys, media coverage, forums, competitor websites, patent research, investor updates, user interviews, psycho- and demo-graphic target market assessments, and more.

It’s also important to summarize this research concisely - some excellent frameworks to glean from include SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats), Porter’s 5 Forces, Perceptual Mapping, and Strategic Group Mapping.

Types of Market Entry Strategies

When strategizing about how to enter new markets, teams should consider business objectives, market and competitor research, real-world examples of successful market entry strategies and the context and constraints surrounding those situations, and financial resources before settling on an entry strategy.

Here are six real-world examples of market entry strategies:

Franchising → McDonald’s: McDonald’s found a recipe that works and opened over 38,000 restaurants in over 100 countries through franchising.

Strategic Alliances → Uber: Uber formed strategic alliances with local transportation providers, governments, and tech companies to expand globally.

Direct Investment → Amazon: Amazon has created a network that enables it to prioritize delivering products quickly and reliably through direct investment in building its own distribution network with warehouses, trucks, planes, etc.

Buying A Company → Google: After Google Glass failed commercially, they purchased a small Canadian startup called North which brought prescription smart glasses that look like regular glasses to market in retail stores and online to help with the company’s broader efforts to build helpful devices and services.

Licensing → Procter & Gamble: P&G has licensed its brands and technology to partners locally in new markets so that they can enter new markets with minimal direct investment.

Joint Venture → Starbucks: In 2015 Starbucks formed a joint venture with Chinese food and beverage company Tingyi Holding Corp to enter the Chinese market.

Frameworks for Market Expansion Approaches

Gleaning from frameworks can help your team better organize complex information to understand the forces at play and make decisions more effectively. Some of the most popular frameworks for market expansion include:

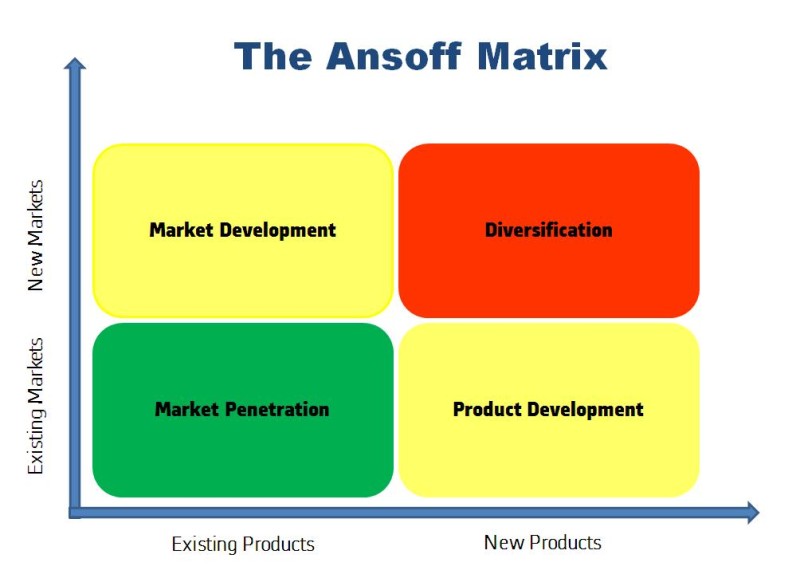

Ansoff Matrix

Named after Russian American Igor Ansoff, an applied mathematician and business manager who created the concept, the Ansoff Matrix consists of four categories - market penetration (selling more of existing products to existing customers), market development (selling existing products to new markets), product development (creating new products for existing markets), and diversification (creating new products for new markets). Teams can use this matrix to help understand opportunities and risks when it comes to expanding into new markets.

Photo Credit: JaisonAbeySabu, Wikipedia

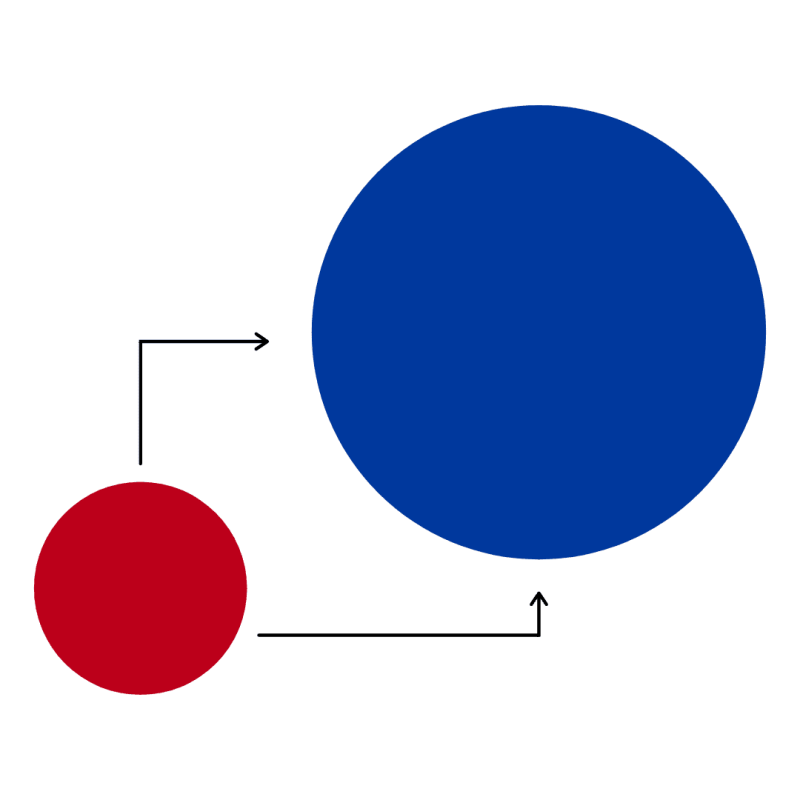

Blue Ocean Strategy

Developed by two business school professors, Chan Kim, and Renée Mauborgne, the duo observed that most companies were competing in overcrowded markets where they were constantly fighting for a share of a limited pool of customers. Believing this was unsustainable, they developed a study where they looked at more than 150 strategic moves by companies across 30 industries including Apple, Cirque du Soleil, Southwest Airlines, and more to unearth patterns and principles that map to successful strategic moves.

Rather than trying to outcompete rivals in existing markets, teams can use a “Blue Ocean Strategy” by offering a unique value proposition that sets them apart from competitors to create new demand and growth without facing direct competition, avoiding intense price and margin pressures of crowded markets, and create better long-term opportunities.

Photo Credit: Blue Ocean Strategy

Porter’s Five Forces

Developed by economist and Harvard Business School professor Michael E. Porter to analyze the competitive forces within an industry, this framework consists of five factors:

The threat of new entrants: How easy or challenging it is for new competitors to enter the market

The bargaining power of suppliers: How much leverage suppliers have over prices and the terms of supply

The bargaining power of buyers: How much leverage buyers have over prices and terms of supply

The intensity of competitive rivalry: How intense competition is within the industry)

Teams can analyze each area to identify unique opportunities and market expansion strategies to capitalize on these opportunities.

SWOT Analysis

A strategic framework developed as a tool for strategic planning, a SWOT analysis can be used to assess a company’s:

S - Strengths: Internal factors that give a company a competitive advantage.

W - Weaknesses: Internal factors that hinder a company’s ability to compete.

O - Opportunities: External factors that present potential opportunities for growth or expansion.

T - Threats: External factors that could negatively impact a company’s performance.

Analyzing these four areas can help teams identify the best approaches for them to pursue market expansion.

Photo Credit: Corporate Finance Institute

PESTLE Analysis

A strategic framework used to assess external factors that could impact a company’s business. This framework considers six factors:

Political: The impact of government policies and regulations on the business

Economic: The impact of economic conditions (i.e. inflation and recession) on the business

Sociocultural: The impact of social and cultural factors (i.e. demographics and consumer trends) on the business

Technological: The impact of technological advancements and changes on the business

Legal: The impact of laws and regulations on the business

Environmental: The impact of environmental factors (i.e. climate change and sustainability) on the business

By taking a close look at these factors, teams can craft expansion strategies that account for potential opportunities and threats in the market.

Photo Credit: SpringWorks

While there are many frameworks available, always think critically about which best suits your unique context and constraints. It may be that none of them do directly, but gleaning them will help you find the right way to make decisions strategically and holistically.

Thinking about market expansion can be both exciting and overwhelming. Common challenges teams face include:

Not understanding all of the variables to be considered: Market research and gleaning frameworks can help significantly with this to give you a “lay of the land” before making any decisions.

Limited resources: It’s easy to think about what you could do as a FAANG company, and maybe a little bit more challenging when you don’t have unlimited resources, but this can actually be a competitive advantage and force you to focus your efforts precisely and act more quickly than a larger, more complex organization.

Legal and regulatory hula hoops: While this one might be the biggest “whopper” of them all, consulting lawyers and regulatory bodies, looking into recent precedents and proceedings, and understanding how competitors handle these challenges can be incredibly valuable in helping you navigate this terrain.

Whether you’re a product manager at a small, rapidly growing, and nimble startup or a larger, established global organization, understanding market expansion strategies can help to inform product decisions you are making day-to-day, the long-term vision of your product(s), your product strategy, roadmap, and requirements, how you think about marketing and selling your product, and how you align stakeholders around all of these critical factors during product development, launch, and beyond.

Lisa Zane

Read also

Create effective product strategy

Experience the new way of doing product management