I spent the first 20+ years of my career working on internal products in various organizations, including several financial services organizations.

At the beginning of 2021, I joined a fintech as a product manager.

Here’s a look at my experience so far and what I’ve learned about product management, fintechs, and the unique characteristics of combing the two.

What is fintech?

Before I get too deep into describing product management in fintech, it’s probably worth describing what fintech actually is, and why product management may differ in those types of organizations from other domains.

Fintech refers to a business that uses technology to enhance or automate financial services. The term fintech usually inspires views of tech companies such as Venmo, Acorns, or Lemonade that help consumers do more with their money without having to work with long-existing financial services companies.

Several tech companies help financial services companies apply technology to their processes and services. The company I work for is one of those organizations.

In both cases, there is a significant focus on the consumer’s experience to bring speed, efficiency, and security to financial services.

My transition to a fintech PM

For most of my career, I worked inside organizations to build products to enable their process.

Often these were back office processes that customers didn’t experience.

Sometimes, I worked on a product that enabled a customer facing process.

In those cases, I interviewed users and stakeholders impacted by the systems, but I didn’t have a great deal of interaction with customers outside the organization.

Now, I need a solid understanding of our customer’s needs.

Since the company I work with builds products, we sell to businesses to support their customer facing processes, I also need to understand the needs of the customers of my customers.

This isn’t necessarily a function of working for a fintech so much as moving from being an internal product person to a product manager working on an external facing product.

The transition to a fintech drives me to build a deeper understanding of financial services, specifically real estate based lending.

I can build upon my experiences as a borrower to put some context around the various aspects of real estate based lending.

It was interesting to go through a home refinance while I was starting work at the fintech as I started getting a picture of why I had a two-inch stack of papers to sign when my refinance loan closed - although that didn’t make it any less annoying.

The transition also reinforced the influence of three critical factors that influence how you approach product development. Those factors include regulatory requirements, a focus on user experience, and a wider range of stakeholders you have to deal with - primarily because of the first two factors.

Ankit Prasad mentions these factors in his description of product management in fintech, and I take a deeper look at each of these factors below.

Regulatory requirements

Ask most people involved with fintech, and in fact the broader realm of financial services - what their least favorite part of that industry is, and they will most likely say dealing with all the regulations.

Because you deal with people’s money, there is inherently a lot of attention on how you deal with that money.

The financial crisis in 2008 - 2010 certainly didn’t help matters and in fact added additional regulations to the entire picture, especially where it comes to lending.

It’s easy to see those regulations as a pain and a barrier, but I prefer to look at them as an opportunity.

Regulations provide the opportunity for fintechs to develop products to help financial services deal with regulations that aren’t likely to change soon.

As an example, there’s an entire ecosystem that has built up around providing lenders with services to collect and organize the information necessary for meeting regulations from organizations such as the CFPB or the SEC in the United States.

Those regulations also, in a perhaps counterintuitive way, aid innovation. They act as constraints on what a fintech can provide that puts guardrails around solutions that you can provide for your customers and your customer’s customers.

For a bit more perspective on the impact of regulations, look at Ram Alagianambi’s description of his experiences working with regulations as a product manager in a fintech.

User experience in formerly “back office” processes

There’s long been the misconception with financial services related software that people had to use the software so there is no point in worrying about user experience. That misconception is not only shortsighted, it’s just plain wrong.

As financial service organizations expose more of their processes to their customers through digital transformation efforts such as mobile and online banking, the importance of user experience becomes much more important.

If you’d like an example of this, compare the experience of applying for insurance at Lemonade.com with the experience at a more traditional insurance company.

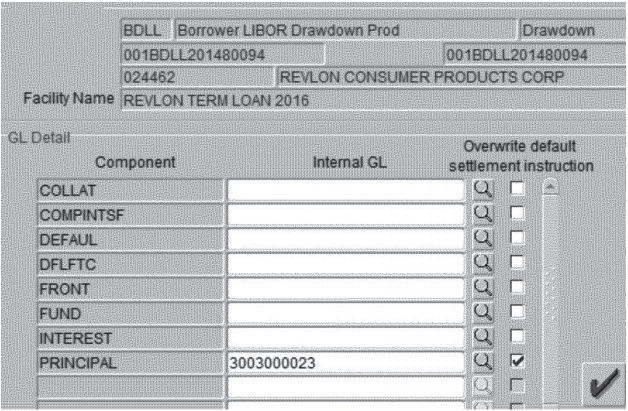

And if you want any more evidence of the importance of user experience, look no further than the issues Citibank ran into when a bad user experience led to the accidental payment of $900 million instead of the intended $7.8 million in interest payments.

Anish Acharya shared three questions that every fintech product manager should ask themselves to keep user experience in mind.

A wider range of stakeholders

Because you have to be concerned about regulations and user experience, you’re going to interact with a wide variety of people in your organization.

I’ve always worked with engineers and QA experts. The move to working on an external product drives a much closer involvement with sales and marketing.

The focus on user experience means there’s a need to work closely with designers and user experience experts.

The need to deal with regulations means that you’re going to interact with compliance experts and lawyers.

The more you can engage those stakeholders regularly, the more effective your product development efforts will be.

Every industry has its unique challenges

I’m only three months into my journey as a fintech product manager, so I know I still have much to learn. Hopefully, my insights and the perspectives I’ve shared from other fintech product managers, including these from Anna Sitnikova give you an idea of what it’s like to be a fintech product manager.

The key thing to remember is that each domain introduces challenges and opportunities for product managers.

Some that are consistent across domains and others that are unique. Even if you aren’t in fintech, you may find that understanding the challenges in the fintech domain may give you some insight into how to deal with challenges in your domain.

Advice for new Fintech PMs

Even though I’ve only been in a fintech for a few months, I have a couple of suggestions for people stepping into a role as a fintech product manager.

If you’re new to financial services altogether, find out who the industry veterans are at your organization and try to absorb as much knowledge as you can. I’m fortunate that my boss and the CEO are both industry veterans are very open about sharing their industry knowledge.

Be prepared to get familiar with the regulatory bodies and industry organizations that cover your product.

For me, that’s meant getting familiar with the CFPB and NCUA. The reading may not be a complete page turner, but the more you’re able to understand regulations and find opportunities, the more successful you’ll be as a product person.

Get familiar with the trends in your particular area of fintechs. Here’s an example of the type of resources you may want to explore as you get more familiar with your industry.

Kent McDonald

Read also

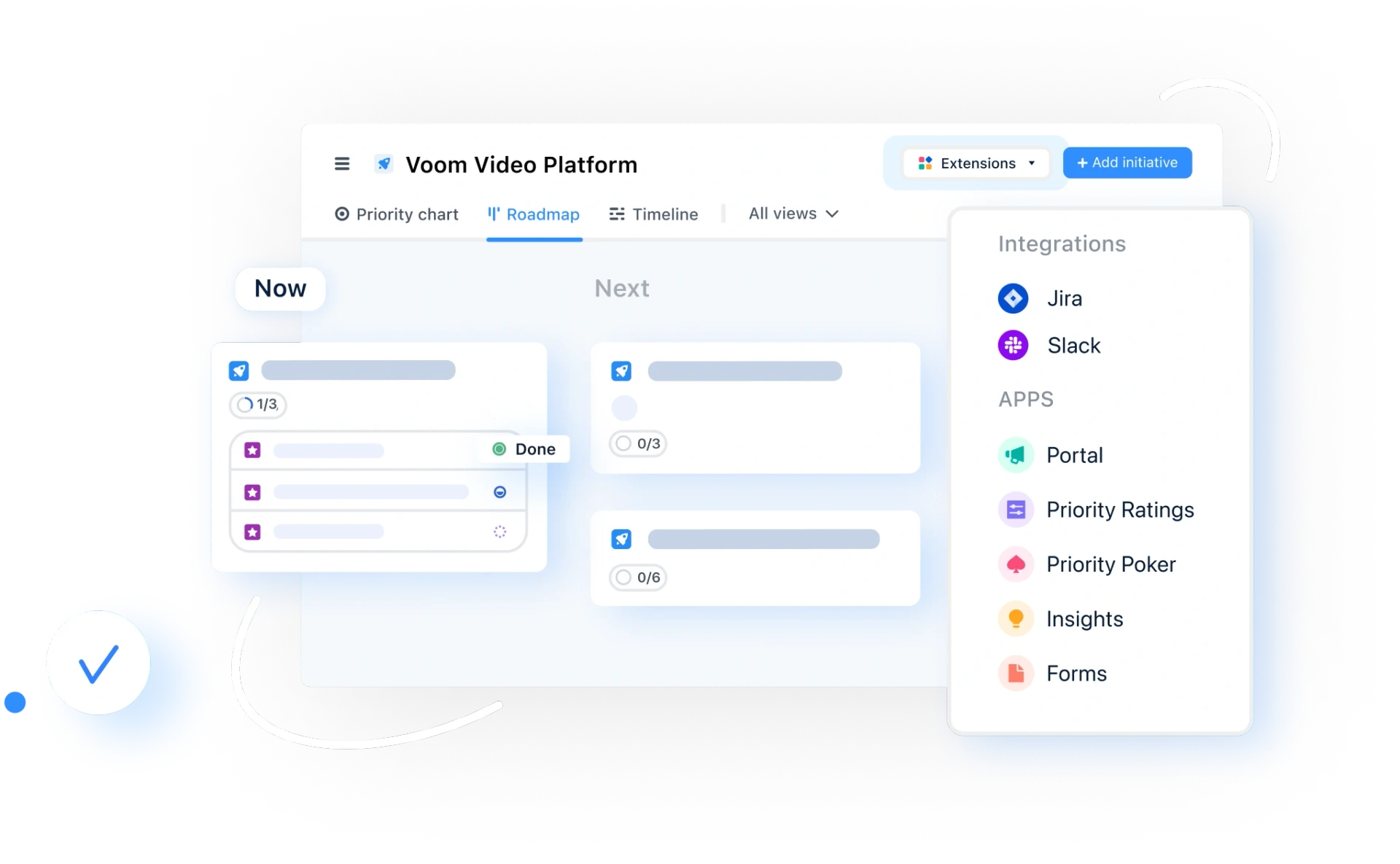

Experience the new way of doing product management

Experience the new way of doing product management