Most brands are excellent at talking about what they do, why they do it, and why clients should work with them.

But when it comes to listening? That can be a whole different ball game.

With such a sharp focus on prospecting for new customers, it’s easy to fall into the trap of failing to engage with the customers you already have. And guess what?

When it comes to developing new products or updating existing ones, your customers are the absolute best source of feedback and new ideas.

Why? Because they’re the ones using your products every day.

Customer satisfaction isn’t just a corporate buzzword: it’s a battle-tested strategy for product success — and the numbers back it up.

According to research carried out by Bain & Company, brands who lead the Net Promoter Score in their space can outgrow their competition by a factor of 2x.

That’s the raw power of customer satisfaction, and it’s often a conversation that begins with the product feedback survey.

Here’s everything you need to know about making them work for your next product development cycle.

Product feedback surveys: definition, process, and benefits

It’s easy to hand-wave product feedback surveys as something you do as a matter of course.

In truth, they can be the catalyst to massive product growth.

But how do you build a product feedback survey that really works? We’ll give you ten great questions to get your creative juices flowing below.

But first, a little context.

The basics of a customer survey feedback

The goal behind a customer feedback survey is ostensibly to understand what customers like — and don’t like — about your products. But there’s a little more to it than that.

A quality product feedback survey can: Help your product team see the forest for the trees. Testing a product internally before release can help iron out some issues, but since your team is so close to the project, it’s easy to miss things. External customer feedback helps teams get a bigger picture view and identify issues they might not have seen before.

Embrace negative feedback. We all like hearing how great we are, but the other type of feedback is most useful.

Establish a process of continuous learning. It’s easy to get set in your ways, especially with a single product team working on a single product. Customer feedback helps disrupt complacency with cold, hard opinions.

The anatomy of the perfect feedback survey

Writing a customer feedback survey might sound like child’s play, but you should consider it something of an art form. Properly composed, the right survey can generate nuggets of information that can transform your product — and your company’s fortunes.

Here are some best practice guidelines on building one the right way.

Surveys with just 1-3 questions have the highest completion rates. That’s those short attention spans for you!

Using the ever-popular Net Promoter Score (NPS) model is a fast way to ensure you get at least some responses. It’s a 1-10 score and takes just a couple of clicks — even if users skip other questions.

Speaking of skipping questions, you should always allow this as an option. Why? Because, perhaps paradoxically, users are more likely to respond if they don’t feel like you’re forcing them to do something.

Don’t fear the incentives. Customer feedback is so helpful that you might consider a dangling carrot, such as a gift card, to encourage customer feedback.

How to ask for feedback (the nice way)

People value honesty. People also appreciate being talked to like, well, people.

For that reason, if you want users to give you the most valuable feedback, you need to make it clear that they can be 100% transparent and honest. In fact, you want to encourage it. Why? Because if you’re phrasing your questions in a way that paints the product only in a positive light, you’ll only receive positively slanted feedback — and that won’t get your product roadmap anywhere.

One great tip is to include questions that are objective, binary, or a blend of both. By doing this, you’re inviting customers’ opinions, but you won’t make them feel uncomfortable or like they’re simply criticizing the product and nothing else. Try to balance the negative with the positive, so customers feel heard but not judged.

The good stuff — 10 product feedback questions that really work

Okay, now that you’re up-to-date with the who, what, and where of product feedback surveys, let’s get down to brass tacks.

Below we’ve collected ten examples of customer feedback questions designed to unlock key insights you can use to improve your product development.

#1: In a single sentence, please describe who you are (age, gender, geographic location) with as much detail as you’re comfortable providing.

When it comes to customer feedback surveys, identity is the lynchpin that holds it all together.

Without knowing who is answering your survey, the results you receive will lose some of their value. Responses won’t be useless, so you can give respondents the option not to describe themselves, but matching up specific viewpoints with certain user cohorts will improve the actionable insights you can glean from these surveys.

#2: What was your goal at the beginning of this session, and did you achieve it?

At the end of the day, the goal of any product is to help users get things done. If your product isn’t delivering on this goal, this can be a showstopper. That’s why it’s so important to get this question out there front-and-center — if something is fundamentally missing from your product, this question will reveal it.

#3: If you had to name one thing missing from our product, what would it be?

Even when your product addresses core use cases, there may still be features or customer requirements that it isn’t meeting. While it’s not always easy for customers to identify what’s missing, this question will give you a clue where to direct your roadmap.

#4: How likely are you to recommend our product to a friend or colleague? (NPS)

Net Promoter Score, or NPS, is an established framework in any Customer Satisfaction Process, presenting a simple 1-10 scale and the question, “How likely are you to recommend this product to a friend or colleague?” Responses are sorted into three buckets: promoters, passives, and detractors.

#5: How satisfied do you feel with your product experience today? (CSAT)

Alongside NPS, another key framework to use within customer feedback surveys is CSAT or Customer Satisfaction Score. CSAT essentially asks users how satisfied they were with their product experience and is usually placed at the end of a session. Like NPS, responses (often stylized as smiley faces) cover positive, neutral, and negative.

#6: How easy was it for you to solve the problem you were tackling today? (CES)

The final established framework we’d suggest to leverage in your customer surveys is the Customer Effort Score or CES. This model uses a scale of Strongly Disagree to Strongly Agree and simply asks the customer how easy it was to solve the problem they were tackling.

#7: What is preventing you from upgrading to a new tier / buying another product today?

Whether your customers think your product is perfect and couldn’t possibly be improved (in which case, way to go!) or something is missing which they’re using other products to solve for, you need to know about it. This question will help you identify upgrade paths to either improve high-tier subscriptions or plan entirely new products.

#8: Do you consider our product to offer good value for money?

There’s not much to say about this one, really. It addresses that age-old question: “Are we charging too much?” (or too little).

#9: Are there any frustrating bugs or errors you come across regularly? Please be as honest as you’d like.

Here’s the honesty factor we mentioned earlier: sometimes, negative feedback is more constructive than positive feedback. It might hurt to hear it, but your product teams are likely to make more impactful immediate changes by fixing bugs or errors than by simply monitoring “nice to have” lists.

#10: Thinking back to before you used our product, is there anything that almost stopped you at the last minute?

We’ve all faced last-minute jitters before clicking that ‘buy” button, but if we need the product solution enough, we’ll click it anyway. But that also means there are plenty of users who won’t. This question aims to identify the people in the former group — and their reasons for almost becoming the latter.

Ready to build better products?

There you have it: the foundations of a Customer Satisfaction Process powered by product feedback surveys. Try out some of the survey questions outlined above and see for yourself just how effective customer feedback can be as a growth tool.

In the meantime, if you’re looking for other ways to help your product managers, owners, and product teams build better products, be sure to check out our other blogs on Creating a Product Adoption Strategy, How to Use NPS to Measure Customer Loyalty in SaaS, and many more on the airfocus blog.

Andrei Tiburca

Read also

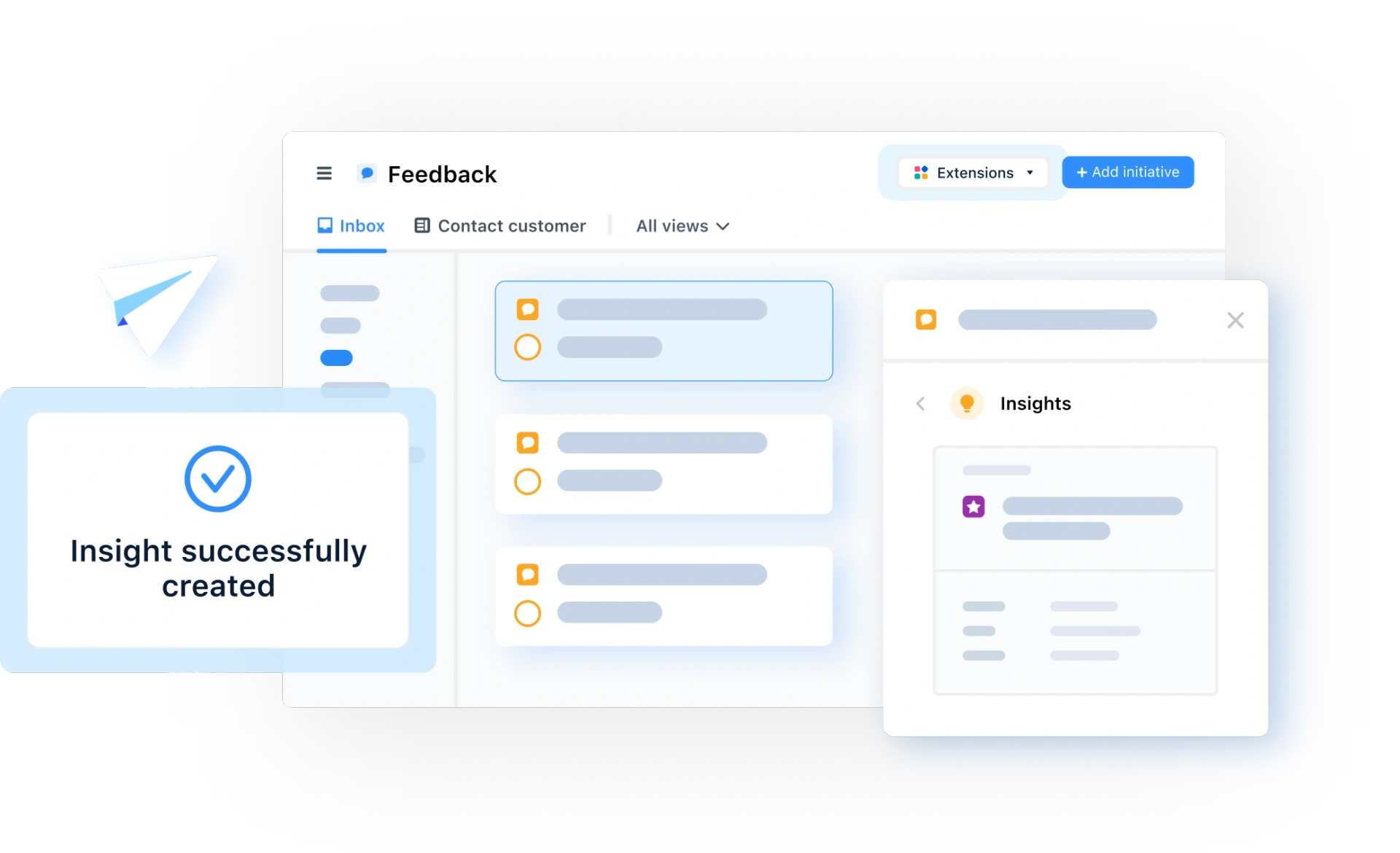

All product feedback in one place

Experience the new way of doing product management