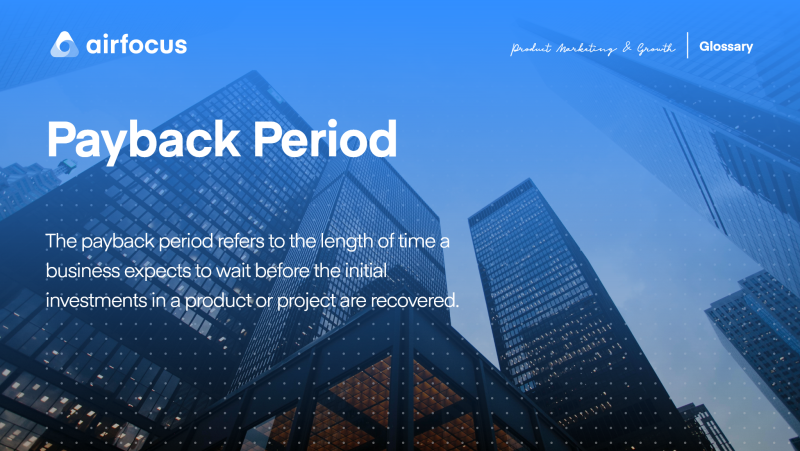

Payback Period

What is a Payback Period

Definition of a Payback Period

A payback period is the length of time a business expects to pass before it recovers its initial investment in a product or service.

Evaluating payback period helps companies recognize different investment opportunities and determine which product or project is most likely to recoup their cash in the shortest time. A fast return may not be a priority for every business in every case, but it’s a crucial consideration all the same.

How to calculate payback period

Companies can calculate the payback period on an investment in two simple ways:

Averaging

With this method, payback period is calculated by dividing the annualized cash inflows a project or product is expected to generate, by the initial expenditure.

When cash flows are forecasted to be steady, the averaging method can deliver an accurate idea of payback period. But if the company could encounter major growth in the near future, the payback period may be a little wide of the mark.

Subtraction

This formula starts by subtracting single annual cash inflows from the initial cash outflow. The subtraction method is most effective when cash flows are likely to fluctuate in the coming years, unlike with the averaging method.

Common challenges with payback periods

Problem is, the payback periods only consider cash flows up to the point at which a company’s initial investment is regained — not subsequent earnings. As a result, a business may fail to see the long-term potential of a project if they focus too much on short-term ROI.

A product or service may require time to grow and reach a bigger audience through positive word of mouth, for example. Failing to acknowledge this potential could cause companies to overlook valuable opportunities.

Another issue is that a product or project can take longer to recoup investments than a company is happy with, but could still be good for the brand and its reputation overall. The payback period methodology fails to take this into account — emphasizing short-time gains instead.

The role depreciation plays in the Payback Period

All businesses need to consider depreciation within their accounting and forecasts, as it will impact the value of goods over time. However, depreciation isn’t a loss of value in cash terms — you haven’t actually lost physical money on that laptop you own, have you? Therefore, when calculating cash flows for payback periods, we need to add depreciation back into the equation. For example… If a product costs $1 million to build and makes a profit of $60,000 after depreciation of 10% but before tax at 30%, the payback period would be: Profit before tax = $60,000 Less tax = (60000 x 30%) = $18,000 Profit after tax = $42,000 Add depreciation = ($ 1 million x 10%) = $100,000 Total cash flow = $142,000 Payback period = Total investment ($ 1 million) / Total cash flow ($142,000) = 7 years (approximately)

General FAQ

Glossary categories

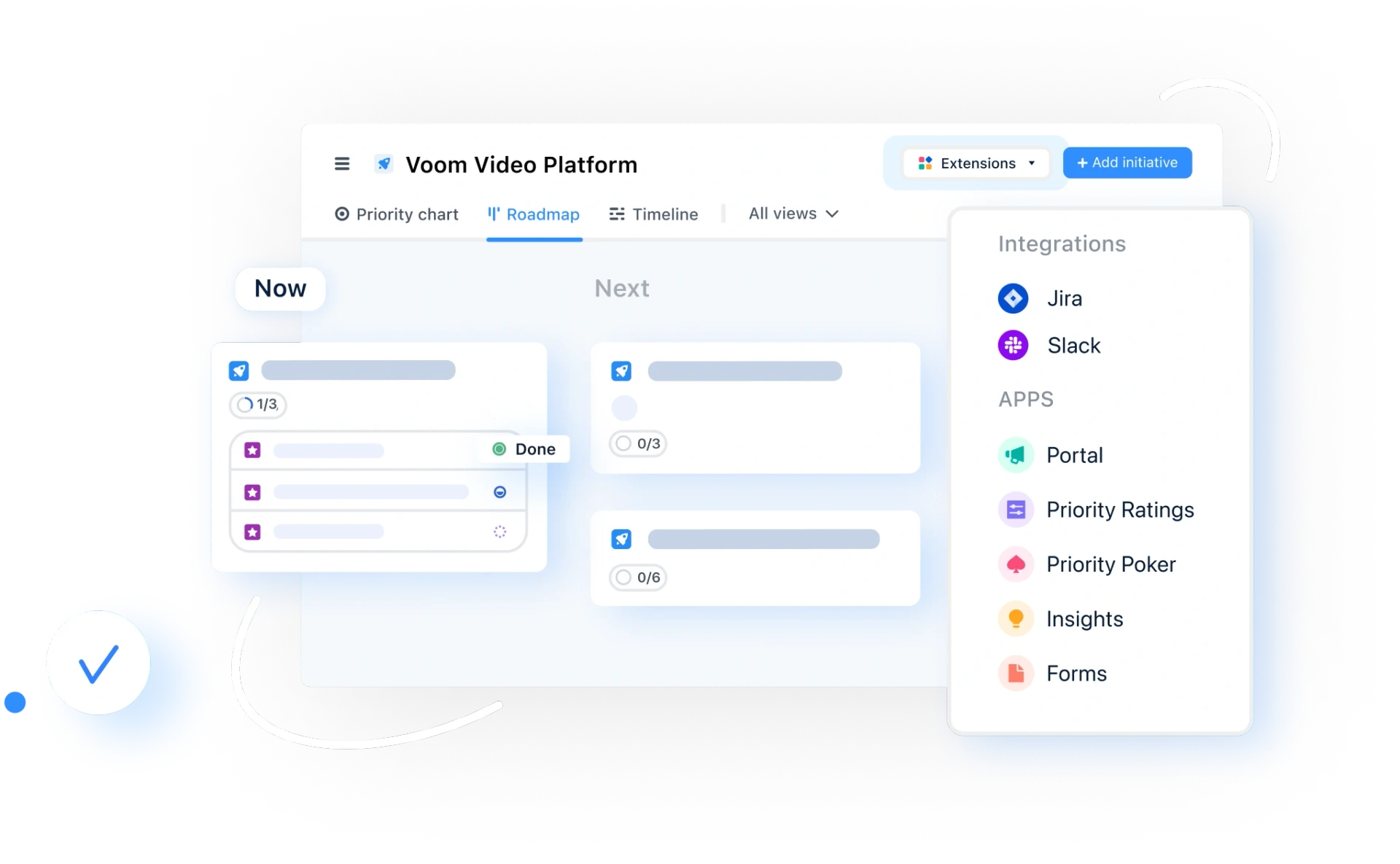

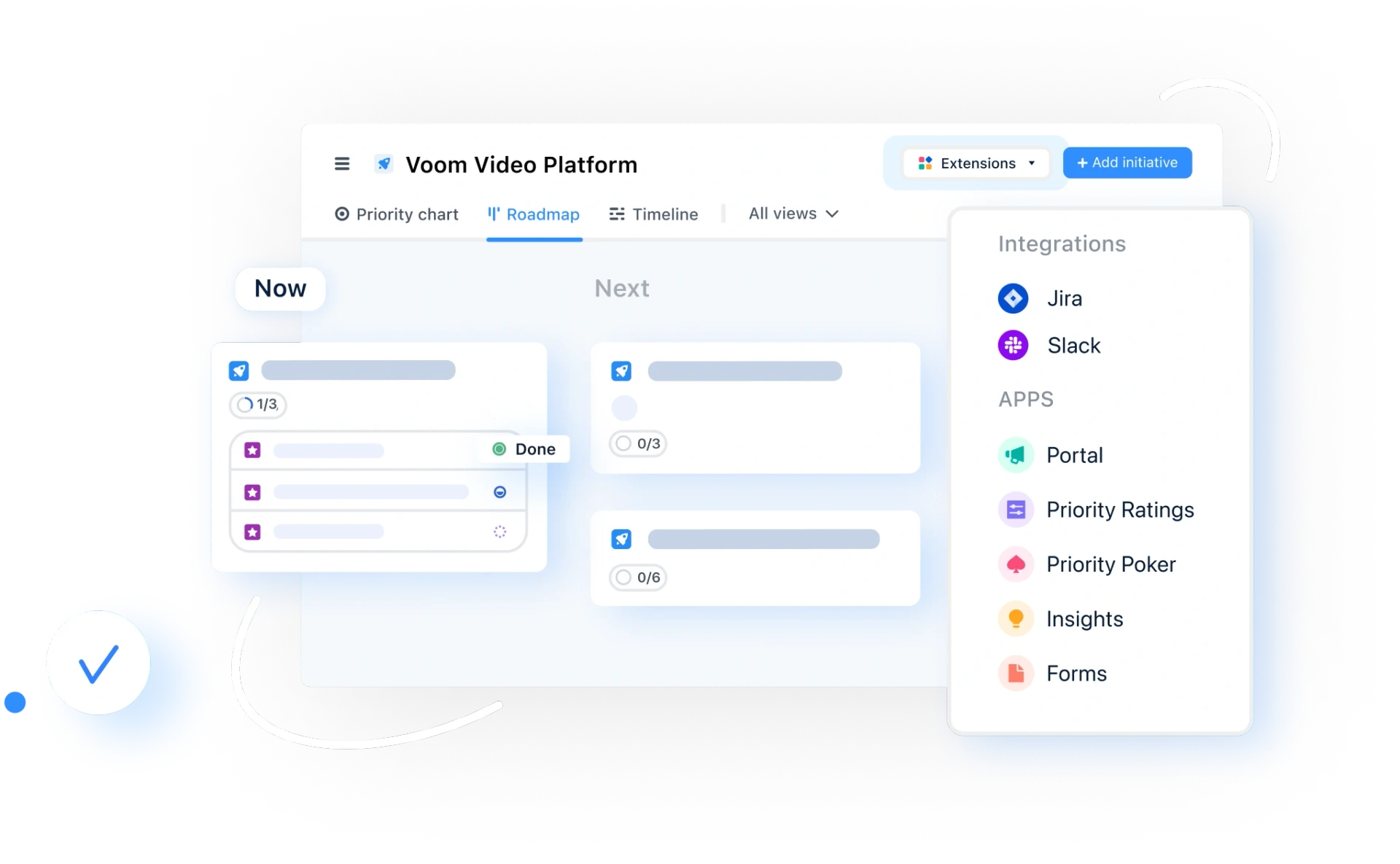

Experience the new way of doing product management

Experience the new way of doing product management