Cash Flow

What is cash flow?

Definition of cash flow

Cash flow is actually a very straightforward term — it refers to the amount of cash moving in and out of your business over a given period of time.

If your business has $20,000 at the start of the month and $30,000 at the end, then you have a positive flow of $10,000. On the other hand, if you started with $20,000 and finished with $5,000 then you have a negative cash flow of $15,000.

One thing to be clear on: cash flow is not the same as profitability.

Profitable businesses can still run out of cash if they don’t manage their spending properly!

How to forecast cash flow

As well as being aware of what your flow looks like month-on-month, you should create a cash flow forecast to cover the next year.

To do this, list out all your expected costs — this should include one-off purchases (like office equipment or staff training) as well as recurring costs. Then you need to calculate your expected earnings from sales for each month.

You’ll need to know how long it takes for customers to pay you, and if you have any customers on credit, to make your best guess regarding when they will pay you.

Once you have all your estimated incomings and outgoings, you can anticipate whether your cash balance will go up or down.

Benefits of forecasting cash flow

A cash flow forecast allows you to plan to spend properly and reduce risk.

You can easily identify areas that might benefit from tighter budgeting, or opportunities to invest in other areas of the business.

Forecasting is especially helpful for seasonal businesses like winter clothing sales, or holiday home rentals, that survive by capitalizing on demand for just a few months in the year.

General FAQ

Glossary categories

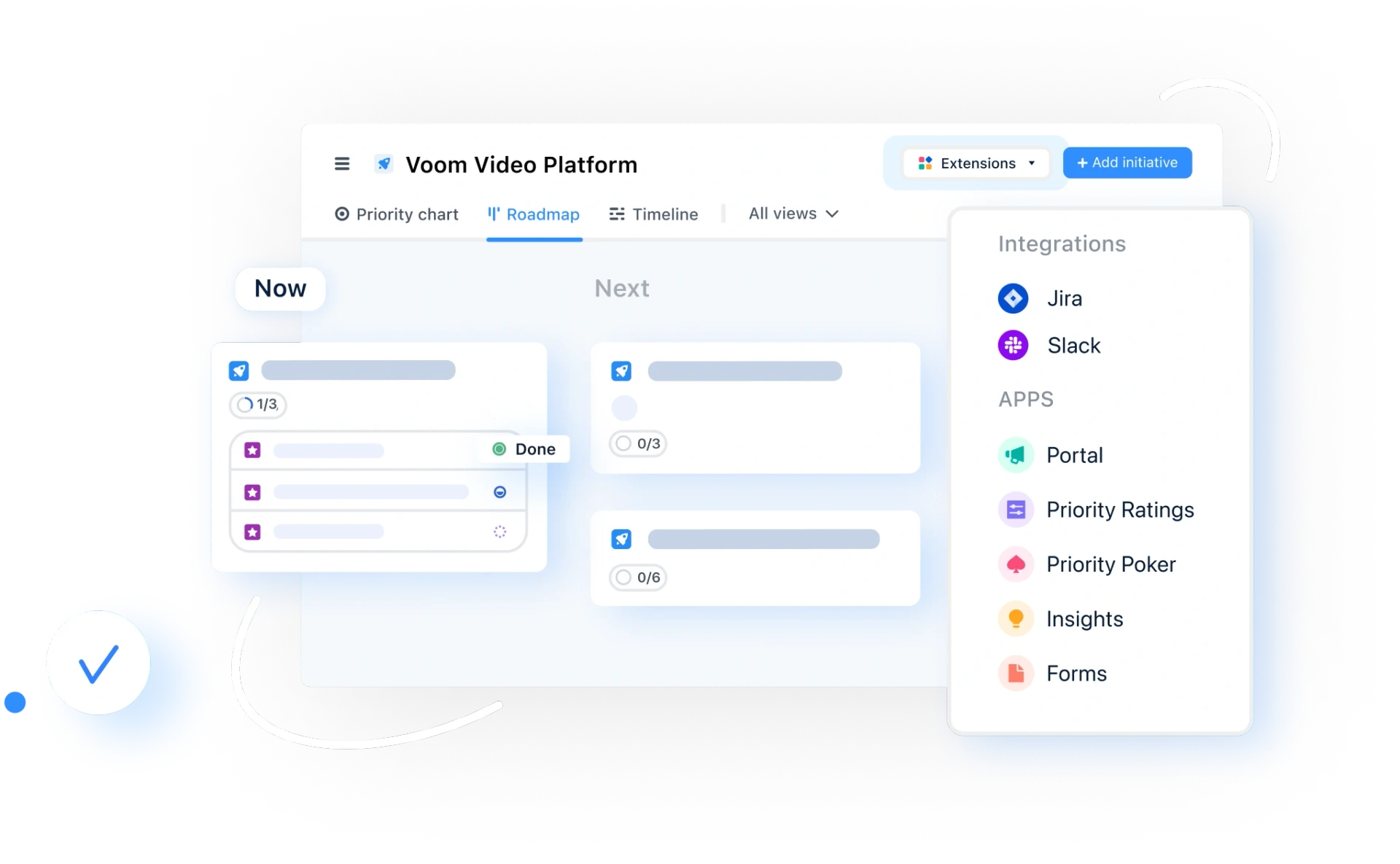

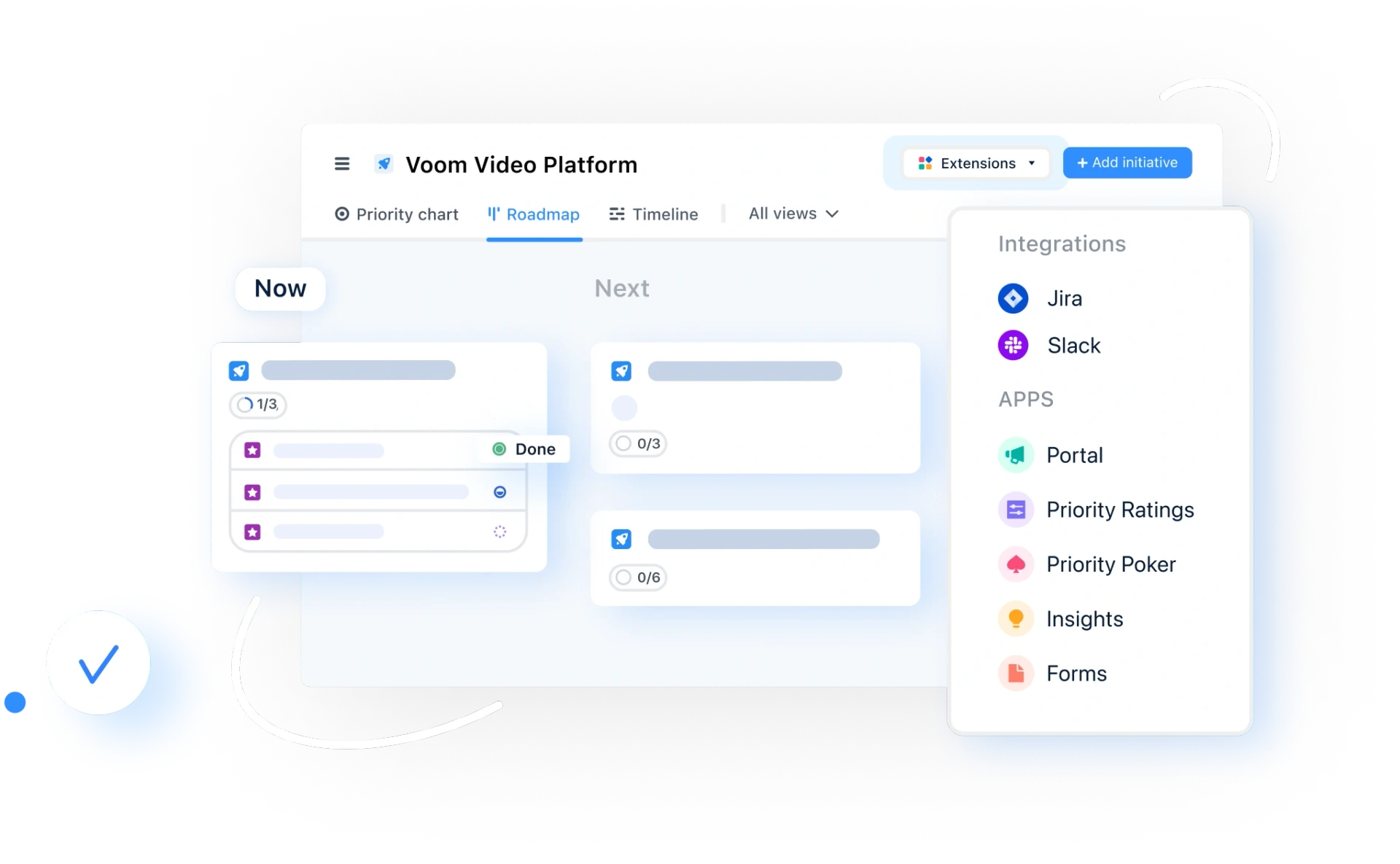

Experience the new way of doing product management

Experience the new way of doing product management