Cost Of Goods Sold (COGS)

What is cost of goods sold (COGS)?

Definition of cost of goods sold (COGS)

The cost of goods sold (COGS) is how much it costs to produce a finished product for the market. Put simply: it is the cost of making the goods a company sells, including the cost of materials, production time and labor.

For traditional manufacturing industries, the cost of goods sold includes expenses like inventory, but in the development world — and particularly when it comes to SaaS — the COGS includes hosting and monitoring costs, account management, license fees, web development and support costs, training, professional services, and subscriptions.

Is the cost of products sold the same as COGS?

Both COGS and cost of sales keep track of the expenses associated with providing an item or service. Direct labor, direct resources like raw materials, and overhead directly related to a manufacturing plant or production facility are all included in these expenditures.

If revenue stagnates as the cost of sales increases, this may be a sign of growing input costs or improper management of direct expenses. The gross profit is calculated by subtracting the COGS and cost of sales from the total revenue.

Cost of sales is frequently used by retailers in their balance statements. Manufacturers use cost of products sold. Service-only companies are unable to accurately link operational costs to tangible commodities, so they are unable to include any cost of products sold on their statement of income. Service-only businesses generally track their cost of revenue or cost of sales instead.

What is typically included in COGS?

Generally speaking, COGS includes all the expenses and costs related strictly to the production of goods. These include:

Cost of items that are meant to be sold again

Cost of raw materials

Cost of all parts utilized to make the product

Cost of direct labor

All the supplies used in selling the product or making it

Overhead costs, such as utilities for the site where manufacturing takes place

Freight or shipping costs

Container costs

Some indirect costs, such as sales force and distribution costs

What is excluded from COGS?

A lot of service businesses have no cost of goods sold. According to generally accepted accounting standards (GAAP), COGS is defined solely as the cost of inventory products sold within a certain period. However, COGS is not addressed in GAAP. Not only do service businesses not have products to offer, but they don’t maintain stock. So, there is no way to deduct COGS costs if they aren’t shown on the business’s income statement.

Examples of pure service businesses include accounting, legal, real estate appraisers, business advisors, professional dancers, etc. All of these sectors do not publish COGS despite the fact that they incur costs regularly to supply their services and have business expenditures. They have something else, called “cost of services,” which can not be included in a deduction of COGS.

Salaries and other administrative and general expenses are also not included in COGS. Certain labor cost types can be included in the company’s COGS as long as they can be directly associated with a specific sale.

What is COGS useful for?

Cost of goods sold is vital for determining the profit margin of a business, and for calculating how profitable and scalable an organization is, or can be.

How to calculate cost of goods sold

To calculate the COGS, you first have to calculate the cost of materials needed to make the product at the start of the year.

To do this, add the costs of any purchases necessary, as well as labor fees, shipping costs, overhead expenses (like electricity or office space), subscriptions, licenses, hosting and any other professional services that you’ve paid for.

After that calculation, you then need to subtract the cost of any materials or inventory (unlikely with SaaS) that are leftover at year-end, and you’ll then arrive at the cost of goods sold of your finished product.

General FAQ

Glossary categories

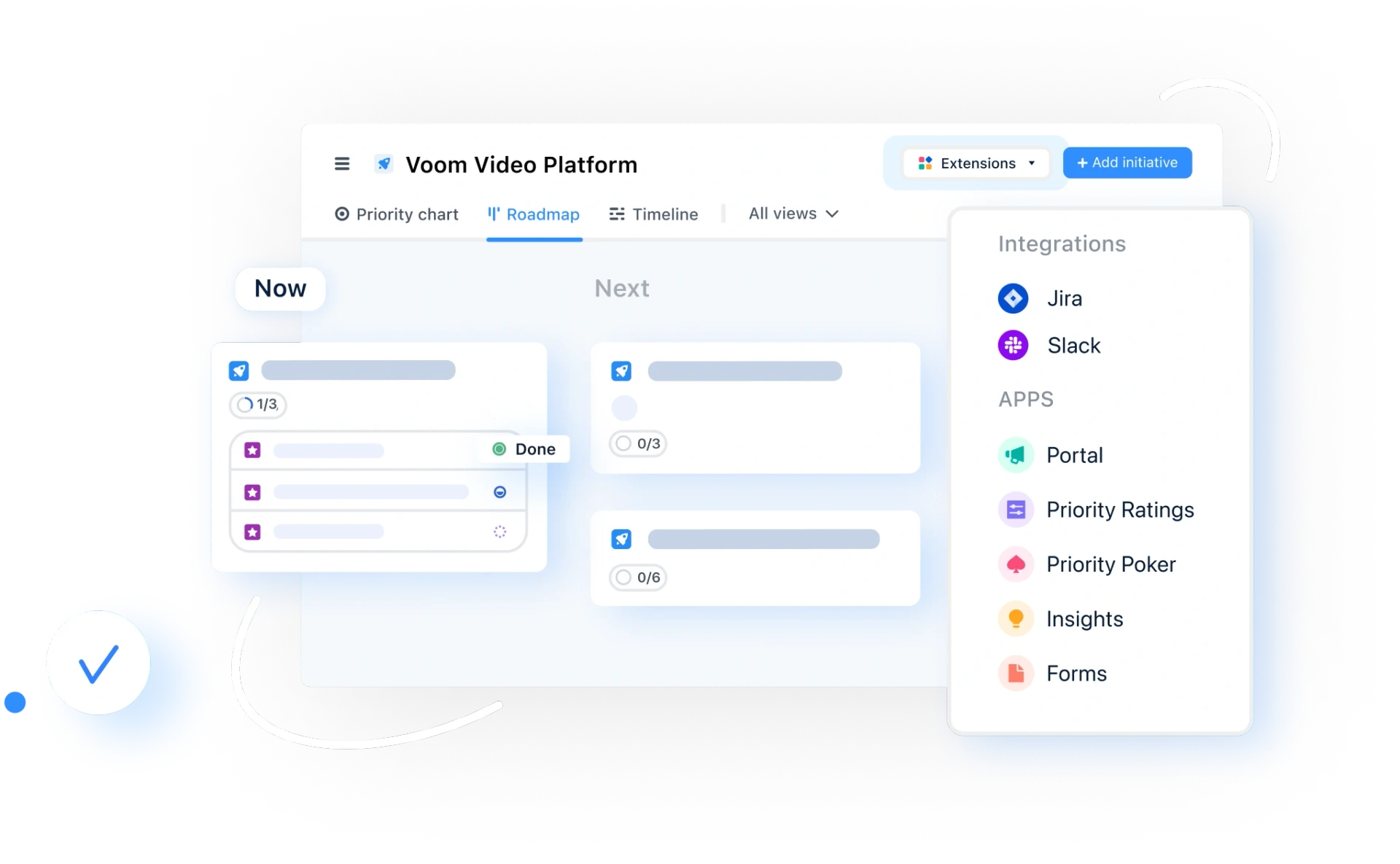

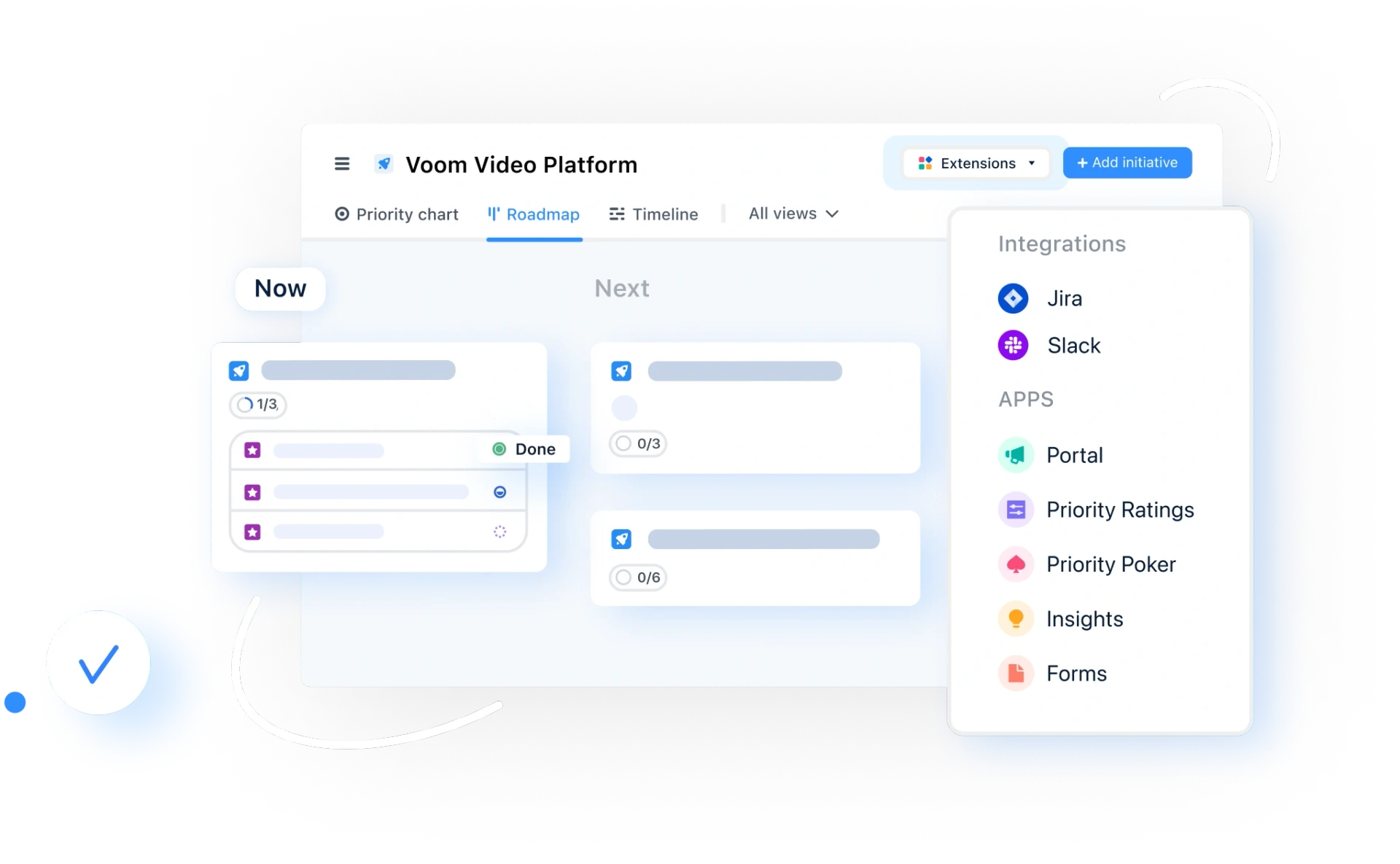

Experience the new way of doing product management

Experience the new way of doing product management